Loans help local businesses add jobs

Published 12:00 am Thursday, May 8, 2008

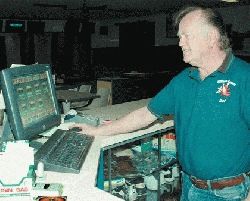

- Del Stout owns and operates Elkhorn Lanes in Baker City. Stout used a government-backed loan to remodel his bowling center and install computers that have boosted league and youth play. (Baker City Herald/Kathy Orr).

By ED MERRIMAN

Baker City Herald

Editor’s note: This is the second story in a series detailing how one local bank is helping new and existing businesses retain and add jobs in Baker County by tapping into government-backed loan programs designed to assist economic development in rural communities.

More than $1.2 million in government-backed loans targeting rural communities helped entrepreneurs buy, expand or remodel nine businesses, adding more than 120 jobs in the Baker County area over the past 18 months.

andquot;For us it was kind of a godsend,andquot; said Terry McQuisten, a Baker City native who, with her husband Dan and partners Ron and Cindy Luelling, took out a $200,000 government-backed loan through Community Bank to buy the Eltrym Theatre from Rudyard Coltman.

andquot;Jeremy Gilpin at Community Bank really did us a big favor by hooking us up with (Northeastern Oregon Economic District),andquot; said Dan McQuisten.

He said the government-backed loan paid a large percentage of the purchase price of the vintage 1940 Eltrym, and required a smaller down payment than was required with conventional bank loans.

andquot;It made a lot of things we needed to do possible, like fixing the sidewalk and concession stand,andquot; McQuisten said.

Terry McQuisten said she gave up a teaching career to move back to Baker City after a close friend died, and she decided to stay and start a new career as a movie theater owner and operator.

andquot;I absolutely love this theater,andquot; she said. It has been converted from the original 700-seat theater with seating on one level to a triplex with stadium seating in one 200-seat theater and two 50-seat theaters.

andquot;I think it is an important business to the city of Baker, and I wanted to make sure it stayed open. It is safe here. The movie theater is just down the street, instead of kids driving to La Grande or Boise to catch a movie.andquot;

The McQuistens, who are in their mid-20s, grew up in Baker City, left to attend college and start their careers, then returned as entrepreneurs.

andquot;This is a neat program. We don’t do 100-percent financing, but we fill the gap between what the borrower needs and what the bank will loan,andquot; said Greg Smith, loan officer with Northeastern Oregon Economic Development District.

He said all but one of the government-backed loans approved in the Baker County area through NEOEDD involved companion loans though Community Bank.

Area businesses in or near Baker County receiving government-backed gap loans or guaranteed loans over the past 18 months include:

n West Slope Enterprises, $100,000 and $250,000 for Natural Structures for construction of a new building, equipment purchase and expansion of water slide manufacturing facilities.

n Stout Investments, $50,000 for remodeling at Elkhorn Lanes bowling alley.

n Trail Enterprises, $100,000 for remodeling and expansion at Oregon Trail Motel and Restaurant.

n Jay Raffety, $75,000 to purchase Main Events sports bar.

n Randamp;D Holding, $75,000 for business expansion at Gentry Ford.

n Oregon Power Solutions, $51,000 to develop technical assistance and consulting business to help landowners putting up wind turbines.

n Naughty Craving Body Taffy, $56,000 to expand body lotions business.

Shirley Jennings, owner of Naughty Craving Body Taffy, said Tuesday she was so busy with Internet sales of her body taffy and All Natural Edible Body Butter that she had no time for press interviews about how the $56,000 government-backed NEOEDD loan helped her business grow.

Smith said the government-backed portion of loans available though NEOEDD is limited to 75 percent of the total amount of the loan. At least 25 percent of the total must come from the borrower, a private lender, a bank loan or some other approved source.

Every one of the nine loans approved during the past 18 months involved bank loans covering the 25-percent borrower match, with the exception of the Naughty Craving Body Taffy, which Smith said had private financing for the 25 percent.

Another government-backed revolving loan fund available through NEOEDD provided $48,000 to Elkhorn Drilling and $25,000 to the Unity Store.

Smith said he believes the behind-the-scenes work he and Gilpin put into qualifying borrowers for government-backed loans and filling out the paperwork is part of the reason so many businesses have participated in those programs recently.

andquot;We’ve taken the government minutiae out of it for the borrowers,andquot; Smith said.

He said Gilpin’s expertise at processing the government-backed loans gave Community Bank a head start in that loan market, but several other area banks are looking into participating, and Smith said NEOEDD is looking forward to working with them in the future.

andquot;These are not grants. They are loans,andquot; said Smith. andquot;They are taxpayer dollars that are invested in Baker County, and we want to make sure these funds are invested wisely.andquot;

Programs available in the Baker County area through NEOEDD include the Economic Development Administration’s Revolving Loan Fund, which has a loan limit of $100,00; the USDA Intermediary Relending Program, which has a loan limit of $250,000; and the Oregon Business Development Fund, which has a loan limit of $750,000.

In addition to those programs, the USDA Business and Industry Guaranteed Loan Program offers loans to a maximum of $10 million, Smith said.

Due to the time and specific knowledge required by a bank to complete all the paperwork, process the loans and work with agency staff, Gilpin said few banks other than Community Bank have been actively pursuing loan packages that include a combination of government loan guarantees.

andquot;Our focus has been to make everybody in the community aware that these programs are available,andquot; Gilpin said.

andquot;When you are working with businesses in small rural communities, these programs allow them to buy that piece of equipment or add employeesandquot; with smaller down payments and longer pay-back schedules, Gilpin said.

Smith said the first step for a business owner or potential business owner is to contact a local bank to see what the bank will loan. If that doesn’t meet their needs, government-backed guaranteed loans, gap loans or direct loans through NEOEDD and the USDA might fill the gap between what an entrepreneur needs and what the bank is able to loan under standard bank lending guidelines, Smith said.

In some cases, Smith said filling the lending gap involves a combination of government-backed loans.

For example, he said a business seeking $1 million more than the bank will loan may be eligible for $750,000 through the Oregon Business Development Fund, $250,000 through the Intermediary Lending Program and $100,000 through the Revolving Loan Fund a total of $1.1 million.

If that’s not enough, the next step would be to tap into the USDA Business and Industry Guaranteed Loan, Smith said, adding that Community Bank in Baker City is doing a large volume of USDA-guaranteed loans.

andquot;It is really important for small-business owners to understand this is not free money. These are not grants. We charge right around prime rate,andquot; Smith said. andquot;We are looking for businesses that will create jobs for Baker County, and most importantly that have a history of running their business successfully.andquot;

Currently, the NEOEDD is processing two more loan applications, which could be in the millions of dollars if approved, he said.

For rural businesses interested in learning more about government-backed loans, Smith said those who aren’t ready to approach a bank can get information from the Small Business Development Center at Eastern Oregon University in La Grande www.eoni.com/sbdc/, or phone 541-962-1532.