EDITORIAL: Baker City’s lodging tax proposal is reasonable

Published 6:50 am Monday, June 17, 2024

- Local law enforcement are maintaining regular patrols in Baker City and Baker County during the coronavirus crisis.

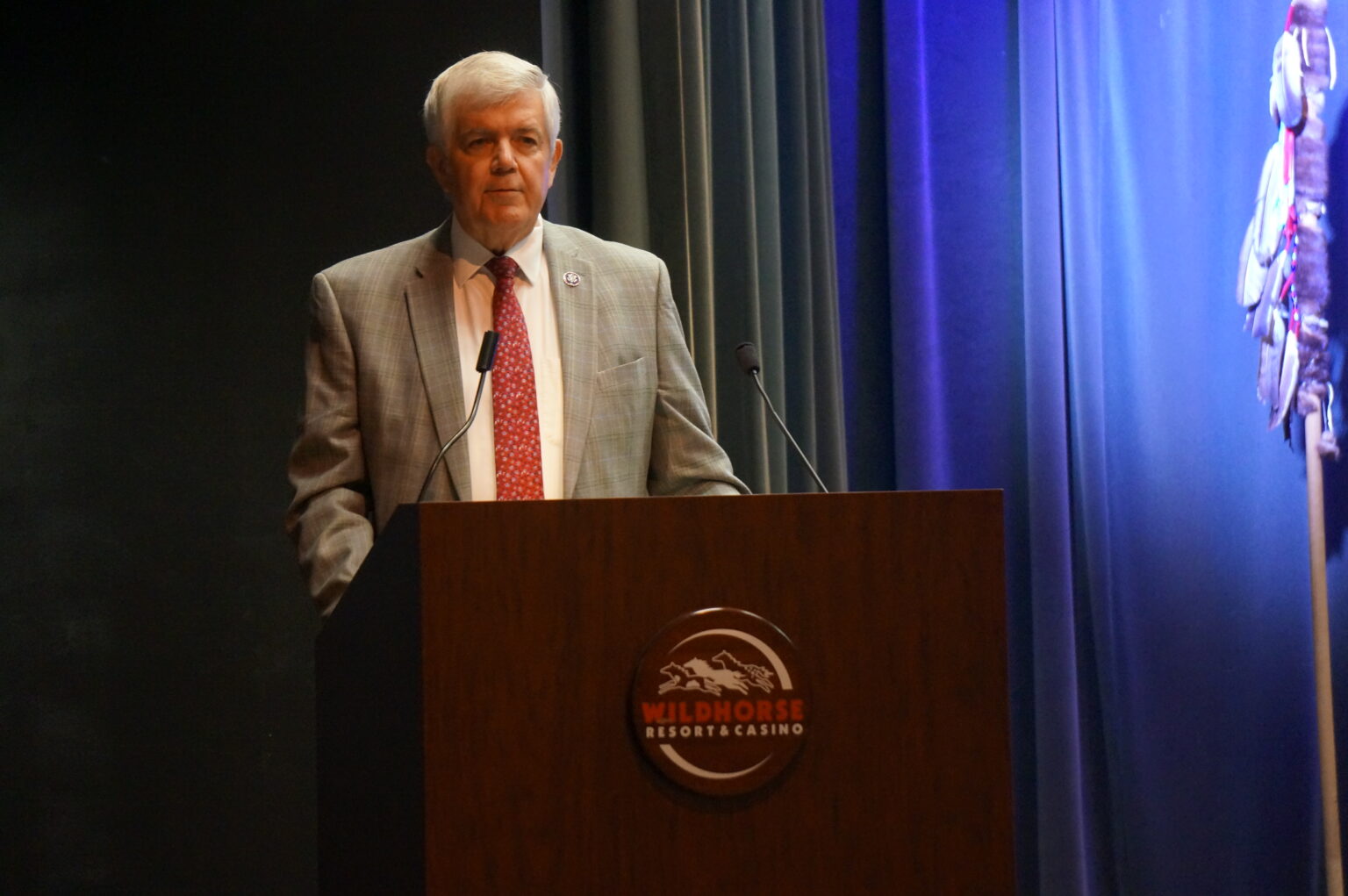

Baker City Manager Barry Murphy thinks the city should receive a share of the taxes that guests pay when they stay at motels and other lodging businesses within the city.

Trending

Murphy’s request is reasonable.

It is not without precedent.

In the late 1990s and early 2000s, when the lodging tax was assessed only within Baker City, 25% of the revenue went to the city’s general fund.

Trending

But that changed with an agreement between the city and Baker County in 2006. Lodging guests now pay the tax in Halfway, Richland, Sumpter and Unity, as well as in unincorporated parts of the county. The tax rate is 7% of the rental charge.

A county ordinance designates that 70% of the revenue be spent for tourism marketing, and 25% for economic development. The county can keep up to 5% for administering the tax.

In a May 30 letter to Baker County commissioners, in which he proposes to negotiate a new city-county agreement for the lodging tax, Murphy wrote that about 80% of lodging taxes are paid by guests at Baker City businesses.

Pinpointing the actual percentage is difficult, in part because companies that handle reservations for vacation rental homes don’t have to report tax collections by jurisdiction.

But obviously the largest share by far of the county’s motel rooms are in Baker City. Murphy’s estimate is likely pretty close to accurate.

He proposes that the city receive about $200,000 per year for its general fund.

That fund, which includes the police and fire departments, had a projected shortfall of $900,000 for the fiscal year that starts July 1. This is due largely to costs, particularly wages and benefits, rising faster than property tax revenue, the largest source for the general fund. The city also has had a net loss of about $500,000 annually due to a previous city council’s decision in 2022 to cease operating ambulances in the fire department. Savings in that department haven’t made up for the loss of about $1 million annually in ambulance billing revenue.

The general fund shortfall prompted the city council to impose a public safety fee, $10 per month for residential customers and $20 for businesses, that took effect June 1 and will raise about $750,000 per year, all of which must be used in the police and fire departments.

Murphy said on June 10 that since the city is requiring residents to pay the public safety fee, he has an obligation to look for other general fund revenue sources, hence his proposal for the lodging tax.

It is an auspicious time to change the tax distribution.

Lodging tax revenue, driven by a rise in tourism and by higher rental rates, set record highs each of the past two fiscal years, increasing from $538,000 in 2020-21 to $860,000 last year. For the first nine months of the current fiscal year, which ends June 30, tax collections were up another 11%, and on pace to total about $954,000.

Moreover, the county has accumulated a cash balance of about $1.2 million in its tourism marketing budget, and $400,000 in the economic development fund.

The bottom line is that there is ample lodging tax revenue to meet Murphy’s request without cutting the other programs that the money pays for.

An Oregon law requires that at least 70% of the money be used for tourism promotion. In Baker County that includes hiring a contract tourism marketing director, a contract to operate the visitors center on Campbell Street near the freeway, and buying advertising in a variety of magazines, travel guides and other publications.

In addition to the proposal to divert $200,000 to the city’s general fund, Murphy suggests using $150,000 to help replace the aging irrigation system at the city-owned Quail Ridge Golf Course. This is a viable use for the money. Tyler Brown, chairman of the county’s transient lodging tax committee, said golf courses are tourism facilities and thus eligible to receive lodging taxes.

Murphy also proposes that the city receive $150,000 to replace the restrooms at the city’s largest park, Geiser-Pollman Park. And he suggests the county approve a two-year contract, $80,000 per year, with Baker City Downtown, the nonprofit that promotes events in the city’s historic downtown, one of the county’s biggest tourist attractions.

Brown said the lodging tax committee endorsed that plan.

Murphy said city and county officials will meet later this month to discuss his proposal.

County officials should seriously consider the plan. The visitors who pay the tax potentially benefit from the city’s police and fire departments, and it’s reasonable that a relatively small share of that tax would, as it has in the past, help support those departments.

And that can happen without diminishing the main purpose of the lodging tax, which is to promote the county and attract more visitors who will not only pay the tax but also patronize a variety of other local businesses and give the county a vital economic boost.