Cathie Wood just dumped $3 million worth of Draftkings stock

Published 5:51 am Tuesday, August 8, 2023

- Jim Cramer Says Cathie Wood Doesn't Understand One Basic Investing Rule

Though DraftKings’ (DKNG) – Get Free Report stock fell hard in 2022, the company’s shares — like many other tech firms — have been rising throughout 2023. DraftKings’ stock is up around 177% for the year so far on news of consistent revenue growth.

Trending

The company reported $875 million in revenue for the second quarter of the year, an 88% increase from last year. This most recent quarter also marks the first quarter in which DraftKings has ever turned a profit, earning $.14 per share, handily beating out the Street expectation of a $.14 loss per share. The company said that it expects profitability to become a theme throughout 2023 and 2024.

DON’T MISS: DraftKings stock could still rally more than 90%

DraftKings also lifted its revenue guidance for the rest of the year to around $3.5 billion in the wake of a strong quarter that saw a 44% increase in monthly unique players and a 33% increase in average player revenue.

Trending

In the midst of this, Wells Fargo analyst Daniel Politzer upgraded the stock to overweight from equal weight, lifting his price target to $37 from $28. Politzer thinks DraftKings could deliver $1 billion in adjusted Ebitda in 2025.

Jim Cramer, host of “Mad Money,” is in line with Politzer’s thinking. He said Aug. 7: “DraftKings should have been up today. The stock has been on fire. You want to be in it before football season, I’ll tell you that much.”

More on Ark Invest:

- Cathie Wood knows how the U.S. economy can avoid a recession

- Cathie Wood sells $13 million of one of Ark’s largest holdings

- Cathie Wood buys millions worth of one surging tech stock

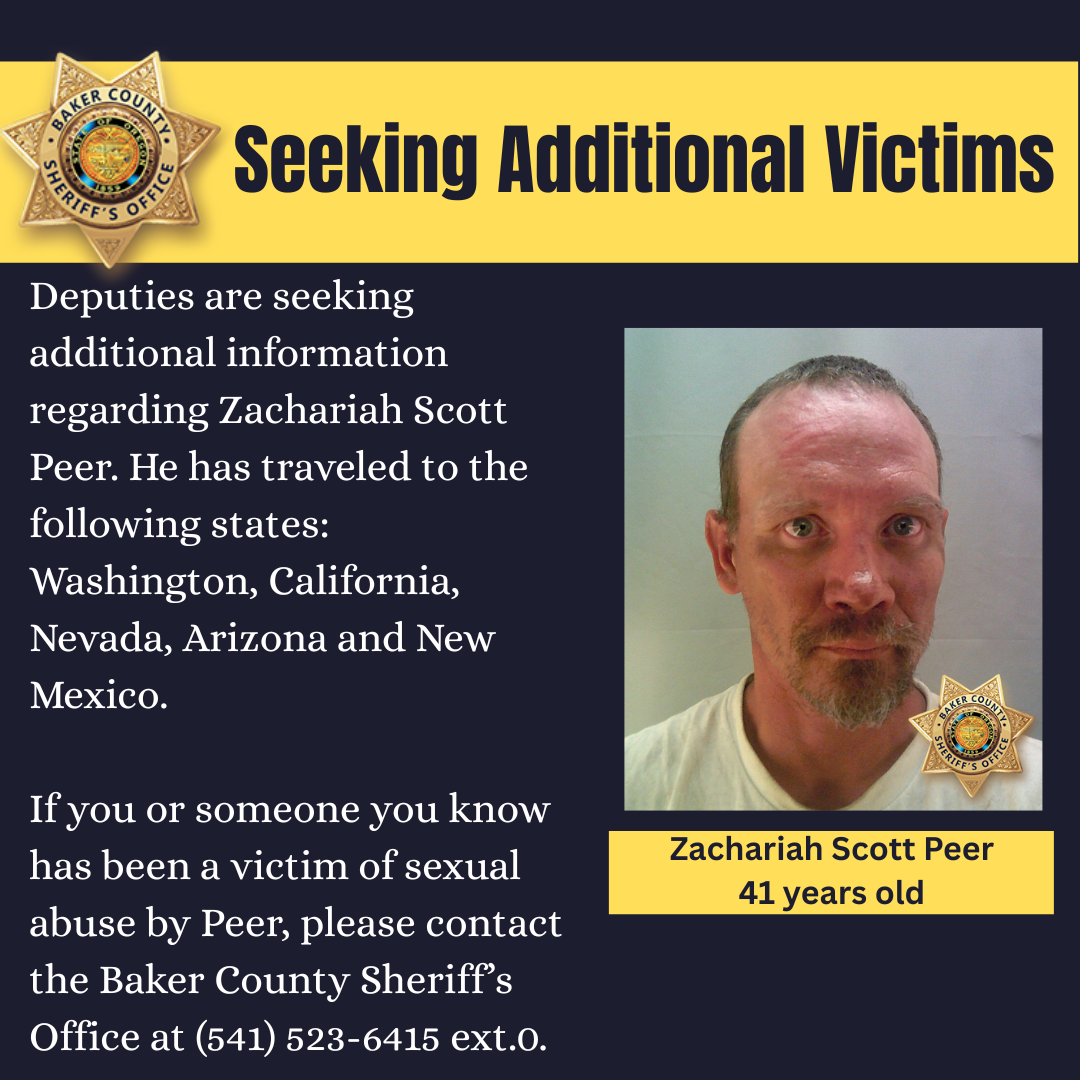

Amid all these bullish outlooks, Cathie Wood, CEO and investment lead of Ark Invest, trimmed Ark’s holding in DraftKings by around $3 million. Ark’s flagship Innovation ETF (ARKK) – Get Free Report sold 88,133 shares and Ark’s Next Generation Internet ETF sold a little more than 6,000 shares.

Even after the selloff, DraftKings remains one of Ark Innovation’s largest holdings, weighted at 4.5% of the fund. The ETF owns around 11.5 million shares of DraftKings, valued at $364.1 million.

DraftKings stock closed Aug. 7 down slightly at $31.63 per share.